Welcome to Manuj Sharma and Company

Our Services

services can help your business thrive.

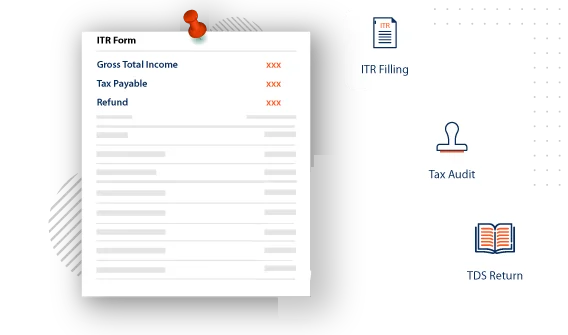

ITR Preparation & Filing

GST Notices & Assessment

GST Return Preparation & Filing

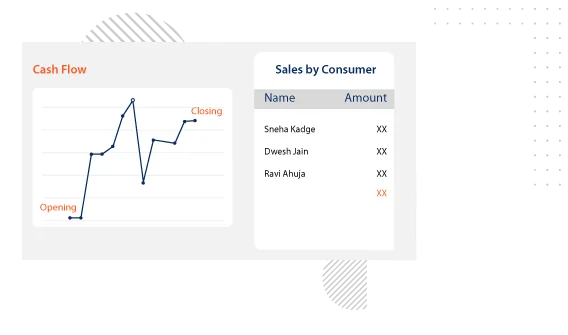

Accounting & Bookkeeping Services

Income Tax Notices & Assessment

Company formation & Compliances

Why Manuj Sharma and Company

Data Privacy

Data is new fuel which make it most important asset for the business house. Strict policy within our organisation is to ensure no compromise on data confidentiality and data is not shared with the third party. Your information is safe with us.

Highly Qualified Team

Our team consists of CA's, Lawyers, CS, IIM, graduate, Actuaries and other supporting staff to make sure you get best services. With 10+ years of experience, our experts uses flexible and customized solutions to provide hassle-free services to any industries.

Process

Manuj Sharma and Company has ISO 9001:2015 certifcation in place. We continuously improve our existing process and try to find new ways for doing the same tasks. We are committed to reduce the time taken to process any task and give unquie experience to our customers.

Business Registration

Accounting Service

GST Registration

ITR filling

Why Choose Us?

SECURED BUSINESS

You can trust us to look after your money.

HELPS TO GROW

We bring in the opportunities that you can avail.

FINANCIAL ADVICE

We provide l advice to manage your business.

AFFORDABLE

We provide cost effective services for our clients